NOTE: If you are not required to collect sales tax, you can skip this section.

*If you need help setting up tax rates, please reach out to us. We are happy to help!

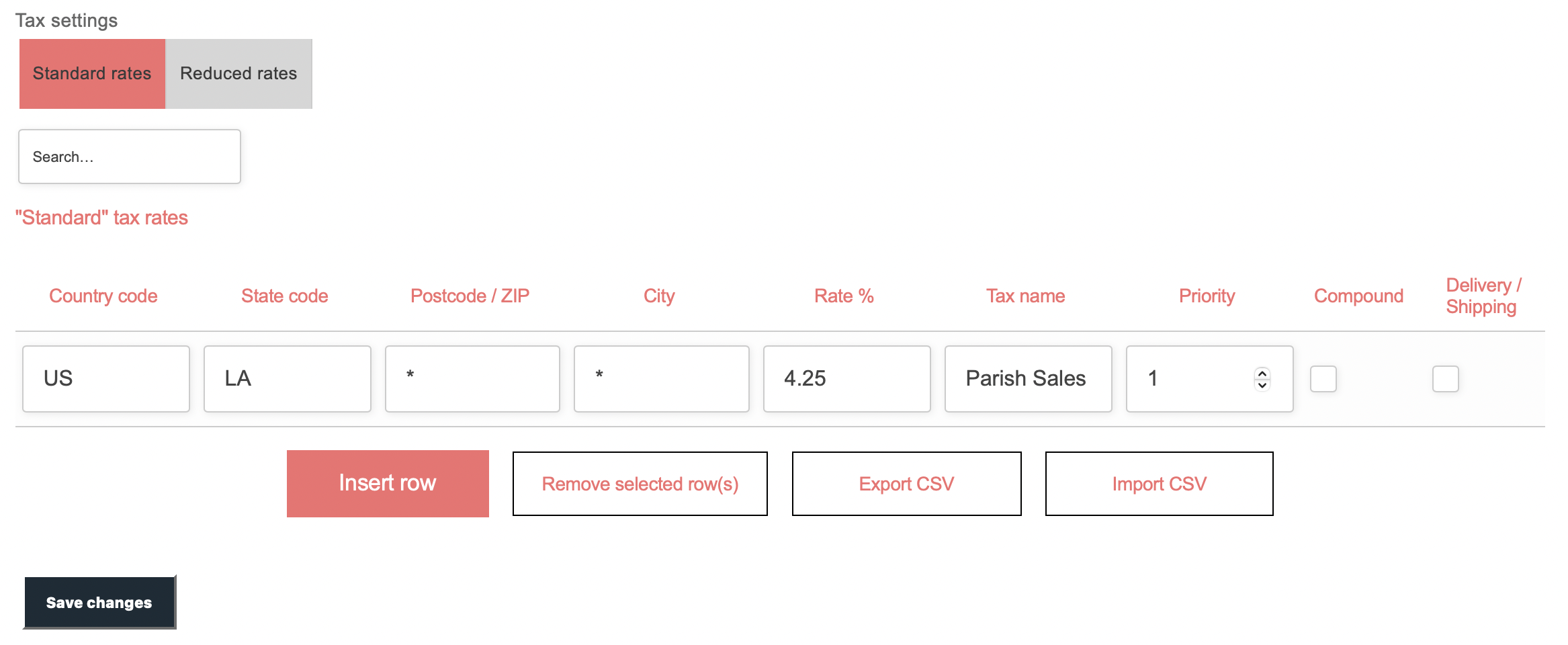

To collect taxes, you will want to set a new Standard rate through the tax tab. You typically only need to create one tax rate for your location, but make sure to check with your local tax authorities regarding the taxes you are required to collect. If you have multiple locations or offer delivery outside of your zip code, you may need to set up additional rates.

Here is an example of how I set my tax rates. For me, all cookie sales are exempt from State taxes but are subject to Parish (county) taxes. I set up a tax rate that charges the county rate to any customer within the State. If I were shipping cookies or cookie-related products out of state, no sales tax would be charged.

Cookie Rookie: Because your cookies are offered exclusively for local pickup, every order will use the local tax rate that you set regardless of the customer’s location. They are picking up the cookies from your location, therefore taxes are due for any taxable items.

(If you sell items that are available at a reduced tax rate, you can set that in the Reduced rate tab. This is not common.)